The world of finance is constantly evolving and it is becoming increasingly important for companies to stay on top of the latest technological trends. DevOps is simply a combination of software development and operations.

Now it has become an essential element for any successful financial institution in the modern age. As we look ahead to 2023, it is clear that DevOps Solution in fintech will key factor for businesses seeking to stay competitive in the financial services sector.

In this blog post, we’ll explore how DevOps can help companies in the fintech industry remain successful and profitable in the years ahead.

What Is DevOps?

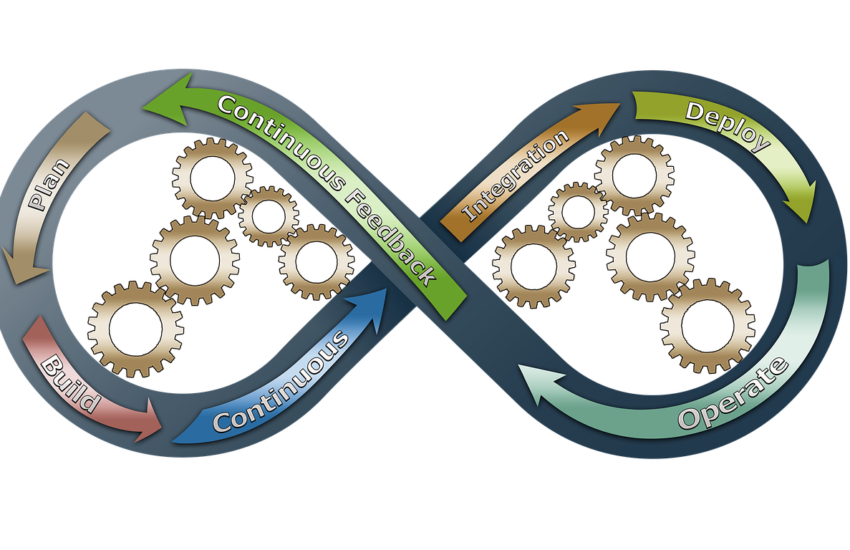

DevOps is an approach to software development and delivery that combines software engineering, information technology, and operations. It combines these disciplines to help organizations create high-performing applications that can be rapidly deployed.

And tested, with continuous monitoring and feedback for improvement. DevOps is a cultural movement that encourages collaboration and communication between development teams. And operations teams, enabling teams to work together towards a common goal.

It emphasizes automation, security, and scalability of applications as well as focusing on customer needs and feedback. Moreover, implementing DevOps in fintech becomes seamless if you hire DevOps engineers with expertise in fintech solution development.

Why Do Fintech Startups & Companies Need DevOps?

Fintech startups and companies must take advantage of DevOps due to the stringent requirements of the financial industry. Stability, availability, and predictability are essential when it comes to running operations successfully in this domain.

For many years, technological changes were made at a glacial pace since restructuring the infrastructure was a huge undertaking. However, with DevOps in Fintech practices and processes, stability, security, and innovation go hand-in-hand.

By setting up servers using Kubernetes and Terraform manifests. And managing cloud infrastructure as code, it’s possible to minimize manual intervention. And stop configuration drift from happening.

How Can DevOps Help Fintech Companies?

- Faster Development Cycles: DevOps can help speed up fintech software development by providing automation, monitoring, and streamlined processes. This reduces the need for manual steps and manual testing, allowing new features and updates to be released much faster.

- Improved Collaboration: DevOps brings people together in a collaborative way. By having a shared understanding of technology, developers, operators, and other stakeholders can collaborate more effectively to build better products and services.

- Cost Savings: Using DevOps tools and practices can reduce costs associated with manual processes and inefficient processes. By automating tasks, organizations can save money in the long run.

- Increased Efficiency: DevOps enables organizations to scale quickly and efficiently by reducing the time it takes to complete tasks. It also allows organizations to take advantage of cloud computing solutions,such as containerization and microservices; which can help improve application performance and scalability.

- Improved Security: DevSecOps helps improve security by providing more visibility into system vulnerabilities, allowing organizations to quickly identify and address any issues before they become a problem. It also helps to ensure that all changes are properly tested before being deployed into production environments.

How Can Companies Get Started With DevOps?

- Assess the current infrastructure: Before making any changes, it is important to assess the existing infrastructure and determine what needs to be changed in order to implement DevOps solution.

- Establish goals:These should include an assessment of the desired outcomes from the transition to DevOps and how these will help the company reach its objectives.

- Analyze processes:This helps to identify areas for improvement and make sure that any new processes are properly designed and implemented.

- Automate processes: Automation also helps reduce errors and ensure that any changes are implemented correctly.

- Implement version control: Version control is essential when using DevOps. It helps to keep track of any changes that have been made and ensures that everyone is working on the same version.

- Monitor performance: Monitoring performance regularly helps to ensure that any changes are being implemented correctly and that any issues can be identified quickly.

- Invest in training: Investing in training for developers, engineers, and other team members help ensure a smooth transition.

Wrapping Up

DevOps in fintech has quickly become essential to succeed in a competitive market. It can help companies optimize their processes, reduce costs, increase reliability, and improve security. With the right implementation of DevOps, fintech companies can experience huge gains in their efficiency and performance.

As technology and industry trends continue to evolve, it is critical that companies stay ahead of the curve. And utilize the latest DevOps capabilities to remain competitive in 2023. By investing in DevOps consulting services, fintech companies will have the tools necessary to move ahead and achieve success.